Asian currencies weaken sharply as the U.S. dollar strengthens following President Donald Trump’s decision to impose new tariffs on several countries. The move has sent shockwaves through global markets, with currencies like the Indian rupee hitting record lows and the Chinese yuan facing downward pressure.

Why Are Asian Currencies Under Pressure?

The dollar index, which measures the greenback against major global currencies, surged 1.11% to 109.58, its highest level in months. This spike has put significant pressure on Asian currencies, which are already grappling with slowing economic growth and trade uncertainties.

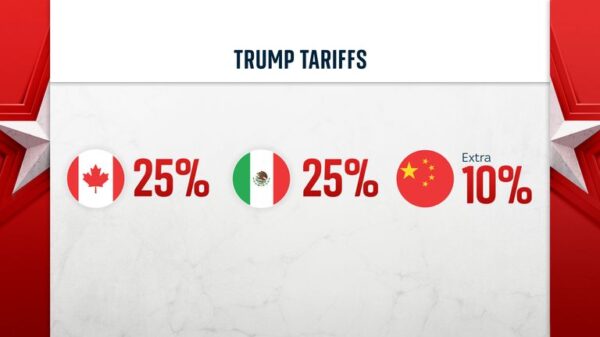

The Chinese offshore yuan dropped 0.36% to 7.347 against the dollar. This came after Trump announced a 10% tariff on Chinese exports to the U.S. Analysts predict the yuan could weaken further. Major banks forecast an average rate of 7.51 per dollar by the end of the year.

Meanwhile, the Indian rupee fell to a record low of 87.101, down 0.66%. The country is struggling with slowing growth. There are also growing calls for rate cuts.

Impact of Trump’s Tariffs

Trump’s tariffs aren’t limited to China. Over the weekend, he also imposed a 25% duty on imports from Canada and Mexico, two of America’s top trading partners. Both countries have vowed to retaliate, while China is preparing to challenge the tariffs at the World Trade Organization.

These measures have created a ripple effect across Asia. The South Korean won depreciated 0.83% to 1,467.65, while the Japanese yen weakened 0.19% to 155.47 against the dollar. However, the yen’s decline was limited by the Bank of Japan’s stance on interest rates.

BOJ Deputy Governor Ryozo Himino recently stated that the central bank would continue raising rates if the economy and inflation align with its forecasts.

Mixed Reactions in the Region

Not all Asian currencies are feeling the heat. The Australian dollar defied the trend, appreciating 1.51% to 0.6117 against the greenback. This resilience highlights the uneven impact of Trump’s policies across the region.

Ray Attrill, global head of foreign exchange at the National Australia Bank, summed it up well: “When Trump says he’s going to do something, we should take him at his word. That’s why markets are reacting the way they are.” He also warned that emerging market currencies could face further downside as growth forecasts are revised downward.

What’s Next for Asian Currencies?

With trade tensions escalating and the dollar showing no signs of slowing down, Asian currencies weaken further in the coming weeks. Investors are closely watching how governments and central banks respond to these challenges. For now, the focus remains on Trump’s next move and its potential impact on global markets.

In short, the combination of tariffs, a strong dollar, and slowing growth has created a perfect storm for Asian currencies. As the situation unfolds, one thing is clear: volatility is here to stay.